Russia faces a significant tax hike to fund the escalating costs of its war in Ukraine, with recent revenue initiatives falling short of covering record defense expenses. In the draft 2025 budget, military spending will consume nearly one-third of total expenditures—the highest percentage since the Cold War and double the allocation for social programs.

Military Spending Fuels Inflation and Currency Struggles

This surge in defense spending has intensified inflation in Russia’s economy, with interest rates reaching 21%, the highest since 2003, and the ruble slipping to a one-year low against the U.S. dollar. Western sanctions block access to international bond markets, limiting Russia’s funding options and prompting the government to lean heavily on domestic tax hikes.

Starting in 2025, corporate and personal income taxes will rise alongside smaller measures, like a car recycling tax. These initiatives aim to generate 1.7% of GDP in additional revenue, yet economists argue it will be insufficient given projected oil price declines—Russia’s main revenue source.

Cuts to Social and Regional Programs

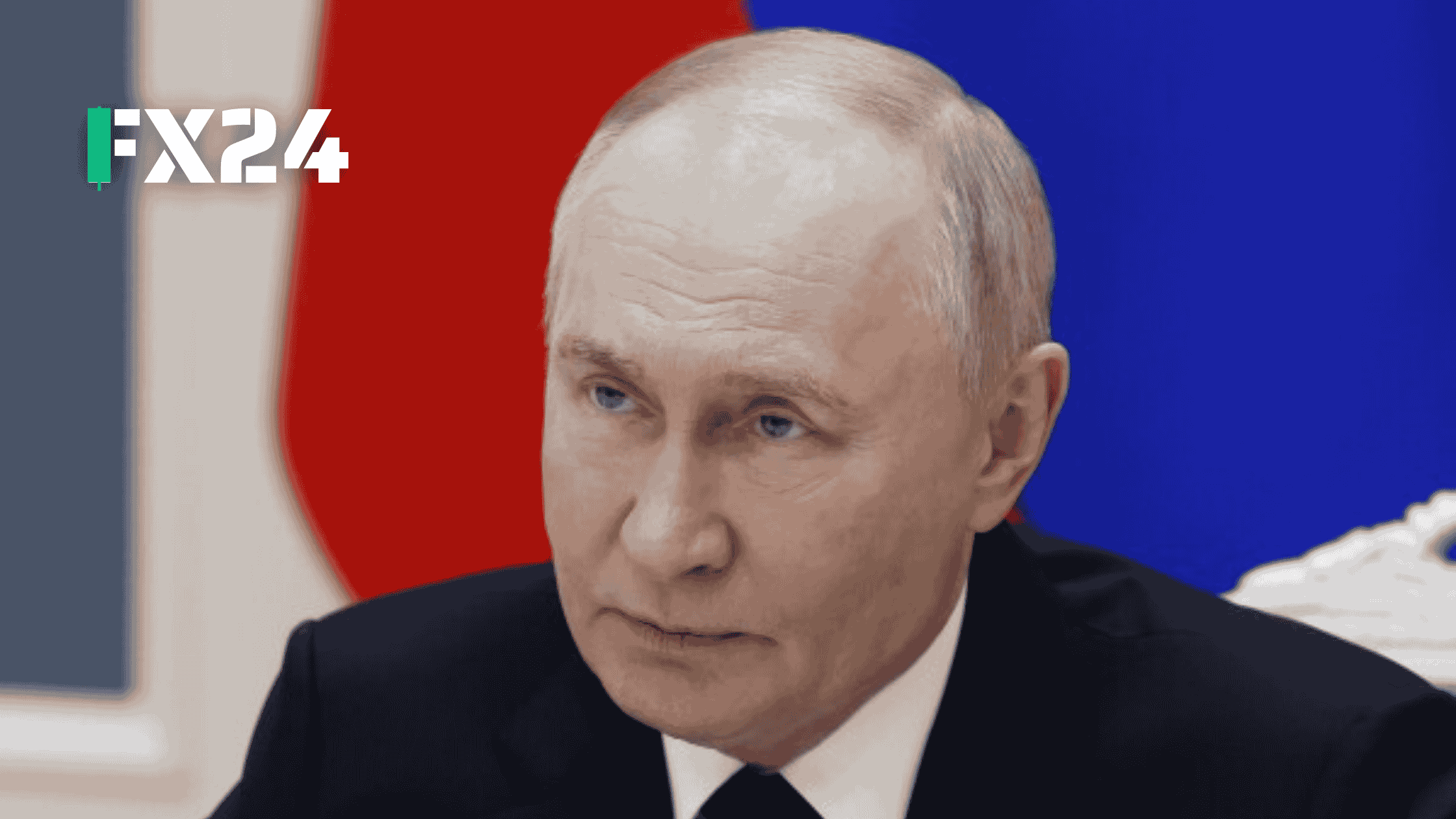

The fiscal strain is forcing cuts to nearly all non-defense areas, including a 31% reduction in regional subsidies for social benefits and an 11% decrease in funding for small businesses. Even President Putin’s “national projects” face delays, as funds are being reallocated to cover defense needs.

Economist Sergei Aleksashenko notes that while military spending has surged by 3-3.5% of GDP since the war began, overall spending growth has slowed, leading to a 1-1.5% GDP reduction in other areas.

Key Insights and Future Outlook

The 2025 budget underscores a shift toward a revenue-extraction model, increasing taxes on foreign companies’ exit and intensifying domestic tax initiatives. Economists predict that as oil prices fall further, Russia will need to find additional revenue, potentially risking social stability.